Support the Museum Today!

Founded in 1984, the Cahoon Museum was created as a cultural resource for the community with a broad mission of promoting education and enjoyment of art. Donations are tax deductible; the museum is a 501(c)3 nonprofit organization, EIN 04-2802203

The Annual Fund is Cahoon Museum’s fund for general operating support.

Please note that donations are separate from membership dues.

Dear Friends and Members,

The Cahoon Museum is a space where people of all ages and backgrounds can come together to experience beauty, creativity, and connection. We’re not just presenting art – we’re building community. In 2024, that spirit of connection fueled meaningful growth across every part of the museum – on the walls, in our programs, and behind the scenes.

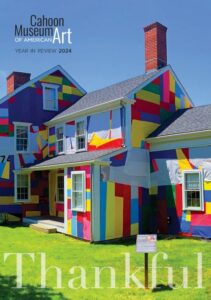

Over the course of the year, we presented ten exhibitions, from cutting-edge contemporary installations to thoughtful presentations of historic art. Joe Cunningham: Quilts for These Times and Small Quilts: Big Stories resonated deeply with audiences, and the bold and joyful public art installation, The Quilted Cahoon, literally wrapped the museum in inspiration. Visitors called these shows “eye-opening,” “vibrant,” and “the best art I’ve ever seen.”

We continued to grow our audience, strengthen community partnerships, and create engaging programs. We also strengthened our capacity, welcoming a new Curator and Development Manager to the team – two key hires that will shape our future growth in exhibitions and fundraising.

Much of this year’s progress happened behind the scenes. We completed a comprehensive Museum Master Plan – a thoughtful, year-long process that clarified our priorities and laid out a vision for the museum’s future. At the same time, a transformative gift from deeply committed donors allowed us to pay off the mortgage on our newly acquired property.

Their extraordinary philanthropy allowed us to move into the future with confidence and momentum.

In the fall, we welcomed a follow-up visit as part of the American Alliance of Museums’ assessment program. The assessor described the Cahoon as “a museum on the rise,” noting strong leadership, clear strategic direction, and a high level of professionalism. These affirming words reflect that the Cahoon Museum has grown into a respected and celebrated cultural leader on Cape Cod.

Thank you for being part of this journey. As a community-supported museum, everything we do – from educational programs to inspiring exhibitions – is made possible through your involvement, your support, and your belief in our mission. Together, we are growing a cultural resource for our community. I hope you feel proud of what we’ve accomplished – and as excited as I am for what’s ahead!

I am grateful to you for your continued support.

Thank you!

Sarah Johnson, PhD

Executive Director & CEO

All donors are listed in the Thankful annual report.

Giving to the endowment is a gift for the future and will allow the museum to fulfill its mission of being an exception place for local and regional art for years to come.

Please help us in ensuring the stage is set for the Cahoon museum to continue to build toward becoming the center for arts and arts education on Cape Cod and beyond.